| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | | | |

NOTICE OF SPECIALANNUAL MEETING OF STOCKHOLDERS OCTOBER 12, 2022MAY 25, 2023

A special

The 2023 annual meeting of stockholders (the “Special Meeting”) of AquaBounty Technologies, Inc. (“AquaBounty”we,” “us,” “AquaBounty” or the “Company”) will be held on October 12, 2022,May 25, 2023, at 8:30 a.m. Eastern Time. The Special Meetingannual meeting will be held entirely online due to the continuing public health impact of the coronavirus (COVID-19) outbreak and to support the health and well-being of our partners, employees, and stockholders. You will be able to attend and participate in the Special Meetingannual meeting by visiting meetnow.global/MLKARJ9www.meetnow.global/M29FZRP, where you will be able to listen to the meeting live, submit questions, and vote. This year’s meeting is being held for the following purposes: To approve the ratification of the approval, filing and effectiveness of the certificate of amendment to our third amended and restated certificate of incorporation (our “Certificate of Incorporation”) filed with the Secretary of State of the State of Delaware (the “Secretary of State”) on May 27, 2022 (the “Share Increase Amendment”) and the increase in the number of shares of our authorized common stock, par value $0.001 per share (the “Common Stock”), effected thereby (the “Ratification”

| · | | to elect seven directors to serve on our Board of Directors (our “Board”) for a one-year term of office until the next annual meeting of stockholders, with each director to hold office until his or her successor is duly elected and qualified or until his or her earlier resignation or removal (“Proposal 1”); |

| · | | to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023 (“Proposal 2”); |

| · | | to approve an amendment to our 2016 Equity Incentive Plan, as amended (the “2016 EIP”), to (i) increase the number of authorized shares of our common stock, $0.001 par value per share (“Common Stock”), issuable under the 2016 EIP from 1,900,000 to 4,300,000, and (ii) require stockholder approval for the repricing of outstanding awards or the cash buyout of outstanding awards (“Proposal 3”); |

| · | | to approve, on a non-binding advisory basis, the compensation paid to our named executive officers (“Proposal 4”); |

| · | | to approve, on a non-binding advisory basis, the frequency of future advisory votes to approve the compensation paid to our named executive officers (“Proposal 5”); and |

| · | | to transact such other business as may properly come before the annual meeting or any adjournment or postponement thereof. |

To approve an adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the Ratification (the “Adjournment Proposal”).

After careful consideration,the board of directors of the Company (the “Board”) our Board recommends a vote “FOR” the Ratification (Proposal 1);election of each of the director nominees listed in Proposal 1, a vote “FOR” Proposals 2, 3 and “FOR”4, and a vote of “1 YEAR” for Proposal 5. Only stockholders of record at the Adjournment Proposal (Proposal 2). As described inclose of business on March 30, 2023, the definitive proxy statement relatingrecord date, are entitled to notice of and to vote at the Company’s May 27, 2022 annual meeting of stockholders (the “2022 Annual Meeting”), which was filed with the SEC on April 14, 2022 (as supplemented by the additional definitive soliciting material filed with the SEC on May 16, 2022, the “2022 Annual Meeting Proxy Statement”), the Share Increase Amendment was proposed to increase the authorized number of shares of Common Stock in order to, among other reasons, provide the Company with the future ability to raise the capital necessary to continue and grow its operations.or at any postponement(s) or adjournment(s) thereof.

At the 2022 Annual Meeting, the Company’s stockholders voted on the Share Increase Amendment. Consistent with the applicable rules concerning the manner in which brokerage firms, banks, broker-dealers, or other similar organizations (collectively, “brokers and/or other nominees”) may exercise discretionary authority to vote on “routine” matters, certain shares of Common Stock held by brokers and/or other nominees and with respect to which the beneficial owners had not provided their broker and/or other nominee with voting instructions were voted by the brokers and/or other nominees in favor of the approval of the Share Increase Amendment. Such votes, and others cast by the Company’s stockholders, were tabulated by the Company’s inspector of elections in accordance with the applicable NYSE rules and, based on the tabulation, the inspector of elections determined that the proposal to approve the Share Increase Amendment was adopted by the requisite vote of stockholders and certified that the proposal had passed. Following this approval, the Company filed the Share Increase Amendment with the Secretary of State on May 27, 2022, and it became effective on the same date.

On June 24, 2022, the Company received a letter on behalf of a stockholder alleging that disclosures in the 2022 Annual Meeting Proxy Statement regarding the authority of brokers and/or other nominees to vote on the Share Increase Amendment in the absence of instructions from the beneficial owners of the applicable shares were inconsistent with how votes were tabulated and counted. For this reason, the stockholder suggested that the votes of brokers and/or other nominees should not have been counted with respect to the Share Increase Amendment, and that the Board should deem the Share Increase Amendment ineffective and make appropriate disclosure of such determination, or seek valid stockholder approval of the Share Increase Amendment.

The Board believes it was and is appropriate to include the affirmative votes cast by brokers and/or other nominees pursuant to their discretionary authority in the tabulation of votes in favor of the Share Increase Amendment and, thus, that the Share Increase Amendment was properly approved and is effective. However, to avoid potential future litigation risk, and to eliminate any uncertainty as to the Share Increase Amendment and the validity of shares of Common Stock that in the future may be issued by virtue of the Share Increase Amendment, the Board has determined that it is advisable and in the best interests of the Company and its stockholders to ratify the approval, filing and effectiveness of the Share Increase Amendment pursuant to Section 204 of the Delaware General Corporation Law (the “DGCL”). In furtherance of this Ratification, the Board unanimously adopted the resolutions attached hereto as Appendix A on August 3, 2022, resolving, among other things, to approve the Ratification, subject to stockholder approval, and recommend that stockholders approve the Ratification.

Your vote is very important. Whether or not you plan to attend the Special Meeting online, the Company hopes you will submit a proxy to vote as soon as possible to ensure that your vote will be counted. Only stockholders of record at the close of business on August 24, 2022 (the “Record Date”) are entitled to vote at the Special Meeting or at any postponement(s) or adjournment(s) thereof. The close of business on August 24, 2022 is also the Record Date for determining the stockholders of record entitled to notice of the Special Meeting. The Ratification is being submitted to stockholders pursuant to Section 204 of the DGCL, under which stockholders of record as of the close of business on March 30, 2022 (the record date for the 2022 Annual Meeting), other than stockholders whose identities or addresses cannot be determined from the Company’s records, will also receive notice of the Special Meeting, but are not entitled to attend the Special Meeting or vote on the Ratification or any other matter presented at the Special Meeting unless they were also stockholders of record as of the close of business on the Record Date.

This notice and the attached proxy statement constitute the notice required to be given to the Company’s stockholders under Section 204 of the DGCL in connection with the Ratification. Under Sections 204 and 205 of the DGCL, when a matter such as the Ratification is submitted for ratification at a stockholderannual meeting any claim that a defective corporate act ratified under Section 204 is void or voidable due to the failure of authorization, or that the Delaware Court of Chancery should declare in its discretion that a ratification in accordance with Section 204 of the DGCL not be effective or be effective only on certain conditions, must be brought within 120 days from the time a certificate of validation in respect of the Ratification is filed with the Secretary of State and becomes effective. If the Ratification is approved by stockholders, the Company expects to file a certificate of validation promptly after the adjournment of the Special Meeting, and any claim that the filing and effectiveness of the Share Increase Amendment is void or voidable due to a failure of authorization, or that the Delaware Court of Chancery should declare, in its discretion, that the Share Increase Amendment not be effective or be effective only on certain conditions, must be brought within 120 days from the time a certificate of validation is filed with the Secretary of State and becomes effective in accordance with the DGCL.

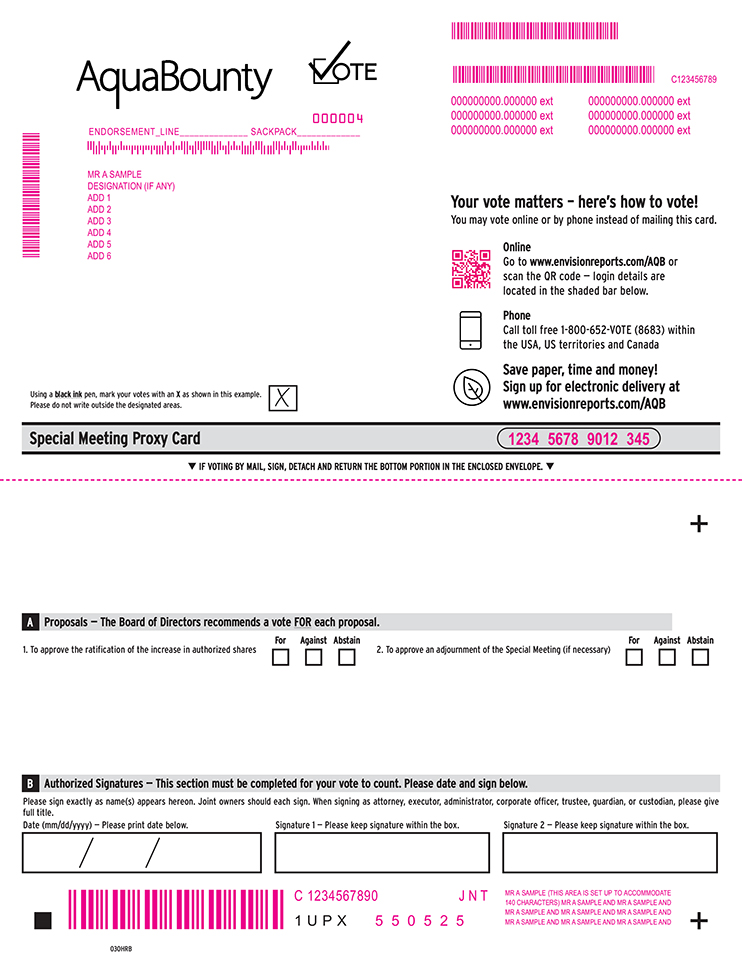

Your vote is very important. Whether or not you plan to attend the Special Meeting online, we hope you will vote as soon as possible. Please vote before the Special Meetingannual meeting using the Internet or telephone,Internet; telephone; or by signing, dating, and mailing the proxy card in the pre-paid envelope, to ensure that your vote will be counted. Please review the instructions on each of your voting options described in the accompanying proxy statement. Your proxy may be revoked before the vote at the Special Meetingannual meeting by following the procedures outlined in the accompanying proxy statement.

| | | | | Sincerely, | | | | | | Sylvia Wulf | | | President, Chief Executive Officer, and Director | | | | Maynard, Massachusetts | | | | | | April 6, 2023 | | |

Maynard, Massachusetts

[•], 2022

Forward-Looking Statements This proxy statement contains “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995, as amended, that involve significant risks and uncertainties about AquaBounty. All statements other than statements of historical fact are forward-looking statements and AquaBounty may use words such as “expect,” “anticipate,” “project,” “intend,” “plan,” “aim,” “believe,” “seek,” “estimate,” “can,” “focus,” “will,” and “may,” similar expressions and the negative forms of such expressions to identify such forward-looking statements. These statements include, but are not limited to, our expectations regarding our personnel growth and risks of not approving and benefits of approving the Plan Amendment (as defined below). Among the important factors that could cause actual results to differ materially from those indicated by such forward-looking statements are risks relating to, among other things, whether or not AquaBounty will be able to raise additional capital, market and other conditions, AquaBounty’s business and financial condition, and the impact of general economic, public health, industry or political conditions in the United States or internationally. For additional disclosure regarding these and other risks faced by AquaBounty, see disclosures contained in AquaBounty’s public filings with the Securities and Exchange Commission, including the “Risk Factors” in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. You should consider these factors in evaluating the forward-looking statements included in this proxy statement and not place undue reliance on such statements. The forward-looking statements are made as of the date hereof, and AquaBounty undertakes no obligation to update such statements as a result of new information, except as required by law. i

2023 PROXY STATEMENT TABLE OF CONTENTS

2 Mill & Main Place, Suite 395 Maynard, Massachusetts 01754 PROXY STATEMENT FOR THE SPECIALANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON OCTOBER 12, 2022MAY 25, 2023

ABOUT THE SPECIAL MEETINGANNUAL MEETING What is the Purpose of the Annual Meeting? This Proxy Statementproxy statement and the accompanying form of proxy are being furnishedmade available to the stockholders of AquaBounty Technologies, Inc. (“we,” “us,” “AquaBounty” or the “Company”) in connection with the solicitation of proxies by theour Board of Directors (the “Board”) of AquaBounty Technologies, Inc. (“we,” “us,” “our,” “AquaBounty” or the “Company”Board”) for use at our specialannual meeting of stockholders (the “Special Meeting”) to be held on October 12, 2022,May 25, 2023, at 8:30 a.m., Eastern Time and any adjournments, continuations or postponements thereof. The meeting will be held via a live webcast available at meetnow.global/MLKARJ9. What is the purpose of the Special Meeting?

The purpose of the Special Meeting is to confirm certain matters that were previously approved by our stockholders. Specifically, at our Special Meeting, stockholders will act uponwww.meetnow.global/M29FZRP, for the following matters outlined in the notice of Special Meeting (the “Notice”):purposes:

To approve the ratification of the approval, filing and effectiveness of the certificate of amendment to our third amended and restated certificate of incorporation (our “Certificate of Incorporation”) filed with the Secretary of State of the State of Delaware (the “Secretary of State”) on May 27, 2022 (the “Share Increase Amendment”) and the increase in the number of shares of our authorized common stock, par value $0.001 per share (the “Common Stock”), effected thereby (the “Ratification”

| · | | to elect seven directors to serve on our Board for a one-year term of office until the next annual meeting of stockholders, with each director to hold office until his or her successor is duly elected and qualified or until his or her earlier resignation or removal (“Proposal 1”); |

| · | | to ratify the appointment of Deloitte & Touche LLP (“Deloitte”) as our independent registered public accounting firm for the fiscal year ending December 31, 2023 (“Proposal 2”); |

| · | | to approve an amendment to our 2016 Equity Incentive Plan, as amended (the “2016 EIP”), to (i) increase the number of authorized shares of our common stock, $0.001 par value per share (“Common Stock”), issuable under the 2016 EIP from 1,900,000 to 4,300,000, and (ii) require stockholder approval for the repricing of outstanding awards or the cash buyout of outstanding awards (“Proposal 3”); |

| · | | to approve, on a non-binding advisory basis, the compensation paid to our named executive officers (“Proposal 4”); |

| · | | to approve, on a non-binding advisory basis, the frequency of future advisory votes to approve the compensation paid to our named executive officers (“Proposal 5”); and |

| · | | to transact such other business as may properly come before the annual meeting or any adjournment or postponement thereof. |

To approve an adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the Ratification (the “Adjournment Proposal”).

After careful consideration,the our Board recommends a vote “FOR” the Ratification (Proposal 1); and “FOR” the Adjournment Proposal (Proposal 2). As described in this Proxy Statement, although our Board believes the Share Increase Amendment was properly approved at the Company’s May 27, 2022 annual meetingelection of stockholders (the “2022 Annual Meeting”), was properly filed and is currently effective, because there may be uncertainty regarding the validity or effectivenesseach of the Share Increase Amendment, our Board is submitting the Ratification to the Company’s stockholders pursuant to Section 204 of the Delaware General Corporation Law (the “DGCL”) to eliminate such uncertaintydirector nominees listed in Proposal 1, a vote “FOR” Proposals 2, 3 and risk of any litigation in connection therewith. Under Section 204 of the DGCL, stockholders of record as of March 30, 2022 (the record date of the 2022 Annual Meeting), other than holders whose identities or addresses cannot be determined from our records, are entitled to notice of the Special Meeting, but are not entitled to attend the Special Meeting or to vote on any matter presented at the Special Meeting unless they were also holders of our Common Stock as of the close of business on August 24, 2022 (the “Record Date”).

It is important to note that approval of the Ratification will:

NOT dilute your ownership in AquaBounty;

NOT change the total number of shares of Common Stock that are currently outstanding;

NOT change the number of shares of Common Stock that you currently own;4, and

NOT change the amount of Common Stock covered under the Share Increase Amendment.

The Ratification WILL merely confirm certain matters that were previously approved by our stockholders.

Why is the Company seeking stockholder approval of the Ratification (Proposal 1) under Section 204 of the DGCL, and what is the effect of that?

Our Board desires to ratify the Share Increase Amendment to eliminate any uncertainty related to the validity and effectiveness of such items. Section 204 of the DGCL provides that no defective corporate act will be void or voidable solely as a result of a failure of authorization of that defective corporate act if it is ratified as provided in Section 204 or validated by the Delaware Court of Chancery in a proceeding brought under Section 205 of the DGCL. Thus, Section 204 allows a Delaware corporation, by following specified procedures, to ratify an arguably defective corporate act . The effect of ratification under Section 204 is that the corporate act is validated retroactive to the date the corporate act was originally taken. Although the Board believes that the Share Increase Amendment was properly approved and is effective, ratification will eliminate all doubt.

What are the consequences if the Ratification (Proposal 1) is not approved by stockholders?

If the Ratification is not approved by the requisite vote of our stockholders, we will not be able to file a certificate of validation in respect of the Share Increase Amendment (the “Certificate of Validation”) with the Secretary of State and the Share Increase Amendment will not be ratified in accordance with Section 204 of the DGCL. The failure to approve the Ratification may leave us exposed to potential claims that (i) the Share Increase Amendment did not receive requisite stockholder approval at the 2022 Annual Meeting, and therefore was not validly filed with the Secretary of State and is not currently effective, (ii) as a result, the Company does not have sufficient authorized but unissued shares of Common Stock to permit future issuances of Common Stock, including pursuant to outstanding warrants, stock options and other convertible securities, and (iii) actions taken by the Company in reliance on the effectiveness of the Share Increase Amendment were improperly effected, although the Company believes that any such claims would be without merit. In addition, the failure to approve the Ratification may preclude us from pursuing, or impair our ability to pursue, a wide range of potential corporate opportunities that might require working capital or additional financing, or otherwise be in the best interests of our stockholders, which could have a material adverse effect on our business and prospects.“1 YEAR” for Proposal 5.

Where can I obtain proxy-related materials and/or what should I do if I received more than one copy of the Notice and proxy materials? A copy of our proxy materials is available, free of charge, on www.envisionreports.com/AQB, the Securities and Exchange Commission (“SEC”) website at www.sec.gov, and our corporate website at www.aquabounty.com.www.aquabounty.com. By referring to our website, we do not incorporate our website or any portion of that website by reference into this Proxy Statement.proxy statement. We intendhave elected to mail theseprovide access to our proxy materials over the Internet. Accordingly, on or about [•], 2022April 6, 2023, we expect to all stockholderssend a Notice of record entitled to vote at the Special Meeting. Pursuant to Section 204Internet Availability of the DGCL, we are also providing notice of the Special MeetingProxy Materials (the “Notice”) to all stockholders of record as of March 30, 2022 (thethe record date entitled to vote at our annual meeting. The Notice will provide instructions on how to access our proxy statement and annual report, along with how to vote via the Internet or by telephone. Instructions on how to request a printed copy of the 2022 Annual Meeting), other than holders whose identities or addresses cannotproxy materials will also be determined fromprovide in the Notice. We encourage stockholders to take advantage of the availability of the proxy materials on the Internet to help minimize our records, but such holders are not entitled to attendcosts associated with printing and distributing our proxy materials and lessen the Special Meeting or to vote on any matter presented at the Special Meeting unless they were also holdersenvironmental impact of our Common Stock asannual meeting of the close of business on the Record Date.stockholders. If your shares are held in more than one account at a brokerage firm, bank, broker-dealer, or other similar organization (a “broker and/or other nominee”), you may receive more than one copy of the proxy materials. Please follow the voting instructions on the proxy cards or voting instruction forms, as applicable, and vote all proxy cards or voting instruction forms, as applicable, to ensure that all of your shares are voted. We encourage you to have all accounts registered in the same name and address whenever possible. If you are a registered holder, you can accomplish this by contacting our transfer agent, Computershare, at (800) 736-3001 or in writing to Computershare Investor Services, PO. Box 30170, College Station, Texas 77842.43078, Providence, Rhode Island 02940-3078. If your shares are held in an account at a broker and/or other nominee, you can accomplish this by contacting that organization. This Proxy Statement and the accompanying form of proxy are expected to be first sent or given to our stockholders, as well as the other persons entitled to receive notice under Section 204 of the DGCL, on or about [•], 2022.1

Why did multiple stockholders at my address receive only one copy of the Notice and proxy materials? Some banks, brokers, andbroker and/or other nominee record holdersnominees may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of the Notice or set of proxy materials is being delivered to multiple stockholders sharing an address unless we have received contrary instructions. We will promptly deliver a separate copy of any of these documents to you if you write to us at 2 Mill & Main Place, Suite 395, Maynard, MA 01754, Attention: Corporate Secretary or call us at (978) 648-6000. If you want to receive separate copies of the Notice or proxy statements or Annual Reports on Form 10-Kmaterials in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker and/or other nominee, record holder, or you may contact us at the above address or telephone number. Why am I receiving the notice for the Special Meeting and this Proxy Statement, but not voting materials?

You may be receiving the notice for the Special Meeting and this Proxy Statement because you were a record holder of Common Stock as of the record date of the 2022 Annual Meeting and, therefore, pursuant to Section 204 of the DGCL, are entitled to notice of the time, place, if any, and purpose of the Special Meeting. However, unless you were also a holder of Common Stock at the close of business on the Record Date, you are not entitled to attend or vote at the Special Meeting, and therefore voting materials have not been provided to you in connection with the notice for the Special Meeting and this Proxy Statement.

What is the quorum requirement to hold the Special Meeting?annual meeting? Our outstanding Common Stock constitutesis the only class of securities entitled to vote at the Special Meeting,issued and outstanding and each shareholder of our Common Stock is entitled to one vote.vote for each share of the Common Stock standing in the name of such stockholder on the books of the Company on the record date for the annual meeting. Common stockholders of record at the close of business on August 24, 2022,March 30, 2023, the Record Daterecord date for the Special Meeting,annual meeting, are entitled to notice of and to vote at the Special Meeting.annual meeting. The presence at the Special Meeting, in person (via the live webcast) or by proxy, of the holders of a majority of the stock issued and outstanding and entitled to vote as of the record date, present in person or represented by proxy, will constitute a quorum at the annual meeting. On March 30, 2023, the record date for the annual meeting, there were 71,338,938 shares of Common Stock issued and outstanding as of August 24, 2022 will constitute a quorum.outstanding. For purposes of determining the presence or absence of a quorum, abstentions and broker non-votes will be counted as present. If a quorum is not present, or represented at the annual meeting, the stockholders entitled to vote at the annual meeting, present in person or represented by proxy, will have the power to adjourn the meeting may be adjournedfrom time to time until a quorum is obtained.present or represented. What is the vote required for each of the proposals? Approval

A summary of our annual meeting proposals and applicable vote standards is set forth below. Proposal 1 the Ratification, willrequires a plurality vote. Proposals 2, 3, 4 and 5 require the affirmative vote of the holders of a majority of the outstanding shares of Common Stock entitled to vote at the Special Meeting. The approval of Proposal 2, the Adjournment Proposal, will require the affirmative vote of the holders of a majority of the outstanding shares of Common Stockstock present in person or represented by proxy at the Special Meetingmeeting and entitled to vote onvote. For Proposal 5, assuming a quorum is present, if a majority is not reached, the Adjournment Proposal and which have actually been voted. Abstentions. Abstentionsoption that receives the most votes will havebe deemed the same effectoption selected by the stockholders.

| | | | | | | | | | | | | | | | | | | | Proposal | | Vote Options | | Vote Required | | Effect of Withhold Votes or Abstentions | | Broker

Non-Votes (if any) | | | | | | | | Election of Directors (Proposal 1) | | FOR WITHHOLD | | At least one FOR vote. Nominees receiving the highest number of “FOR” votes are elected. If nominees are unopposed, election requires only a single vote or more. | | No Effect | | No Effect | | | | | | | | Ratification of Appointment of Independent Auditors (Proposal 2) | | FOR AGAINST ABSTAIN | | Majority of shares present and entitled to vote | | Count as AGAINST vote | | No Effect (1) | | | | | | | | Amendment to our 2016 EIP (Proposal 3) | | FOR AGAINST ABSTAIN | | Majority of shares present and entitled to vote | | Count as AGAINST vote | | No Effect | | | | | | | | Advisory Vote on Compensation of our Named Executive Officers (Proposal 4) | | FOR AGAINST ABSTAIN | | Majority of shares present and entitled to vote | | Count as AGAINST vote | | No Effect | | | | | | | | | | | | Advisory Vote on the Frequency of Future Advisory Votes on Compensation of our Named Executive Officers (Proposal 5) | | ONE YEAR TWO YEARS THREE YEARS ABSTAIN | | The frequency receiving the votes of the holders of a majority of shares present and entitled to vote (2) | | Count as AGAINST vote | | No Effect | | | | | |

(1) This proposal is considered to be a vote against Proposal 1, the Ratification. Abstentions will have no effect on the outcome of Proposal 2, the Adjournment Proposal, as abstentions are not considered votes “cast” under the DGCL. Broker Non-Votes.If“routine” matter. Accordingly, if you beneficially own your shares and do not provide voting instructions, your broker and/or other nominee has discretionary authority to vote your shares on this proposal.

(2) Assuming a quorum is present, if a majority is not reached, the option that receives the most votes will be deemed the option selected by the stockholders. Broker Non-Votes If you are a beneficial owner of shares held in “street name” by a broker and/or other nominee such firm is requiredand you do not instruct your broker and/or other nominee how to vote your shares, accordingyour broker and/or other nominee may still be able to vote your instructions, if provided.shares in its discretion. Under the rules of the New York Stock Exchange, which are also applicable to Nasdaq-listed companies, brokers and/or other nominees that are subject to New York Stock Exchange rules may use their discretion to vote your “uninstructed” shares on matters considered to be “routine” under New York Stock Exchange rules but not with respect to “non-routine” matters. A broker non-vote occurs when a broker and/or other nominee has not received voting instructions from the beneficial owner of the shares and the broker and/or other nominee cannot vote the shares at its discretion because the matter is not considered a routine matter“non-routine” under NYSE rules. Proposals 1, 3, 4 and 5 are considered to be “non-routine” under New York Stock Exchange rules for which brokers have discretionary authority to vote. As each proposal is considered a routine matter, if you provide a proxy without giving specific voting instructions, thesuch that your broker and/or other nominee may not vote your shares on those proposals in the absence of your voting instructions. Conversely, Proposal 2 is ableconsidered to exercise discretionbe a “routine” matter under New York Stock Exchange rules and vote uninstructed shares. We, therefore,thus if you do not expect that anyreturn voting instructions to your broker non-votes will occur at the Special Meeting. What are the procedures for voting?Your Vote

Your vote is very important. Whether or not you plan to attend the Special Meeting,annual meeting, please vote by proxy in accordance with the instructions on your proxy card or voting instruction card (from your broker and/or other nominee).

Stockholders of Record. If your shares are registered directly in your name with our transfer agent, Computershare, you are a stockholder of record and you received the proxy materials by mail with instructions regarding how to view our proxy materials on the Internet, how to receive a paper or email copy of the proxy materials, and how to vote by proxy. You can vote via the live webcast of the Special Meetingannual meeting at meetnow.global/MLKARJ9www.meetnow.global/M29FZRP or by proxy. There are three ways stockholders of record can vote by proxy: | (1) | by telephone (by following the instructions on the proxy card);

|

| (2) | by Internet (by following the instructions provided on the proxy card); or

|

| (3) | by mail (by completing and returning the proxy card enclosed in the proxy materials).

|

(1) by telephone (by following the instructions on the proxy card; (2) by Internet (by following the instructions provided on the proxy card); or (3) by mail, (by completing and returning the proxy card enclosed in the proxy materials prior to the annual meeting). Unless there are different instructions on the proxy card, all shares represented by valid proxies (and not revoked before they are voted) will be voted as follows at the Special Meeting: “FOR” Proposal 1, the Ratification, and “FOR” Proposal 2, the Adjournment Proposal. annual meeting: | · | | FOR the election of each of the director nominees listed in Proposal 1 (unless the authority to vote for the election of any such director nominee is withheld); |

| · | | FOR the ratification of the appointment of Deloitte as our independent registered public accounting firm as described in Proposal 2; |

| · | | FOR the approval of an amendment to the 2016 EIP, as amended, to increase the number of authorized shares of Common Stock issuable from 1,900,000 to 4,300,000 and to require stockholder approval for the repricing of outstanding awards or the cash buyout of outstanding awards as described in Proposal 3; |

| · | | FOR the approval of the non-binding advisory vote on the compensation paid to our named executive officers as described in Proposal 4; and |

| · | | FOR a vote of 1 YEAR for the frequency of future non-binding advisory votes on our named executive officers' compensation as described in Proposal 5. |

If you provide specific voting instructions, your shares will be voted as instructed. Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day and willuntil the polls close at 11:59 p.m., Eastern Time, on October 11, 2022.during the meeting.

Beneficial Owners of Shares Held in Street Name. If your shares are held in an account at a broker and/or other nominee, then you are the beneficial owner of shares held in “street name,” and such organization forwarded to you the proxy materials. There are two ways beneficial owners of shares held in street name can vote by proxy in accordance with the instructions provided to you by your broker and/or other nominee: (1) by mail, by following the instructions on the voting instruction form; or (2) by Internet, by following the instructions on the voting instruction form. | (1) | by mail (by following the instructions on the voting instruction form); or

|

| (2) | by Internet (by following the instructions on the voting instruction form).

|

Although we do not know of any business to be considered at the Special Meetingannual meeting other than the proposals described in thisthe proxy statement, if any other business is presented at the Special Meeting,annual meeting, your signed proxy or your authenticated Internet or telephone proxy will give authority to each of Sylvia Wulf, David A. Frank and Angela M. Olsen to vote on such matters at his or her discretion.

YOUR VOTE IS IMPORTANT. PLEASE VOTE WHETHER OR NOT YOU PLAN TO ATTEND THE SPECIALANNUAL MEETING IN PERSON VIA THE LIVE WEBCAST. How do I attend the meeting? This Special Meetingannual meeting will be held virtually. To attend and participate in the Special Meeting,annual meeting, stockholders will need to access the live webcast of the meeting. To do so, please visit meetnow.global/MLKARJ9meeting, available at www.meetnow.global/M29FZRP. If you are a stockholder of record, you do not need to register to attend the Special Meetingannual meeting via the live webcast. To attend, just follow the instructions on the notice or proxy card that you received. We encourage you to access the meeting prior to the start time, leaving ample time for the check-in. If you are a beneficial owner of shares held in “street name” as of the Record Daterecord date and wish to attend the Special Meeting,annual meeting, whether you intend to vote your shares at the meeting or not, you must register in advance to do so. To register, you must submit proof of your proxy power (legal proxy from the broker and/or other nominee that holds your shares) reflecting your AquaBounty Technologies, Inc. holdings, along with your name and email address, to Computershare. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on October 11, 2022.May 22, 2023. You will receive a confirmation of your registration by email after Computershare receives your registration materials. Requests for registration should be directed to Computershare as follows: By email Forward the email from your broker and/or other nominee, or attach an image of your legal proxy, to legalproxy@computershare.com

By mail Computershare AquaBounty Technologies, Inc. Legal Proxy P.O. Box 43001 Providence, RI 02940-3001 To attend the Special Meetingannual meeting as a “street name” holder, following registration, visit meetnow.global/MLKARJ9www.meetnow.global/M29FZRP and follow the instructions on the notice or proxy card that you received. Access to the webcast will begin on October 12, 2022,May 25, 2023 at 8:1500 a.m., Eastern Time, and you should allow ample time for check-incheck-in. procedures. Can I ask questions at the meeting? If you wish to submit a question during the Special Meeting,annual meeting and are entitled to do so as a stockholder of record or stockholder in “street name” as of the Record Date,record date, you may log into, and submit a question on, the virtual meeting platform by following the instructions provided through the platform. All questions presented should relate directly to the proposals under discussion. Questions from multiple stockholders on the same topic or that are otherwise related to a particular topic may be grouped, summarized and answered together. If questions submitted are irrelevant to the business of the Special Meetingannual meeting or are out of order or not otherwise suitable for the conduct of the Special Meeting,annual meeting, as determined by the Chair or Corporate Secretary in their reasonable judgment, we may choose to not address them. If there are any matters of individual concern to a stockholder and not of general concern to all stockholders, or if a question posed was not otherwise answered, such matters may be raised separately after the Special Meeting.annual meeting. Our Special Meetingannual meeting will be governed by the meeting’s Rules of Conduct, which will address the ability of stockholders to ask questions during the meeting and rules for how questions will be recognized and addressed. The meeting’s Rules of Conduct will be available on meetnow.global/MLKARJ9the site prior to the Special Meeting.annual meeting. What do I do if I experience technical issues during the meeting? The virtual meeting platform is supported across browsers (MS Edge, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets, and cell phones) running the most updated version of applicable software and plug-ins. Note: Internet Explorer is not a supported browser. Participants should give themselves plenty of time to log in and ensure they have a strong Internet connection, and they can hear streaming audio prior to the start of the meeting. Approximately 15 minutes prior to the start of and through the conclusion of the Special Meeting,annual meeting, a support team will be ready to assist stockholders with any technical difficulties they may have in accessing or hearing the virtual meeting. If you encounter technical difficulties with the virtual meeting platform on the meeting day, please call the technical support number that will be posted on the meeting website.

Additional information regarding technical and logistical issues, including technical support during the Special Meeting,annual meeting, will be available at meetnow.global/MLKARJ9,on the meeting website, which stockholders should refer to in the event that the Special Meetingannual meeting is adjourned or in the event of a technical failure or similar issues.issue. How do I revoke a proxy? If you are a stockholder of record, you may revoke your proxy at any time before it is actually voted at the Special Meetingannual meeting by: delivering written notice of revocation to our Corporate Secretary at 2 Mill & Main Place, Suite 395, Maynard, Massachusetts 01754, which must be received by our Corporate Secretary prior to the start of the Special Meeting;

| · | | delivering written notice of revocation to our Corporate Secretary at 2 Mill & Main Place, Suite 395, Maynard, Massachusetts 01754, which must be received by our Corporate Secretary prior to the start of the annual meeting; |

submitting a later-dated proxy prior to the applicable cutoff times, as described above; or

| • | | · | | submitting a later-dated proxy prior to the applicable cutoff times, as described above; or |

| · | | attending the Special Meetingannual meeting via the live webcast available at meetnow.global/MLKARJ9www.meetnow.global/M29FZRP and voting. |

Your attendance at the Special Meetingannual meeting will not, by itself, constitute a revocation of your proxy. You may also be represented by another person attending the Special Meetingannual meeting by executing an acceptable form of proxy designating that person to act on your behalf. Shares may only be voted by or on behalf of the record holder of shares as of the Record Date,record date, as indicated in our stock transfer records. If your shares are held in “street name,” then you must provide voting instructions to the broker and/or other nominee, as the appropriate record holder, so that such person can vote the shares in accordance with your preferences. In the absence of such voting instructions from you, the record holder will be entitled to vote your shares on “routine” matters. Please contact your broker and/or other nominee if you would like directions on how you may change or revoke your voting instructions. Who is making this solicitation? This solicitation is made on behalf of our Board, and we will bearpay the expenses associated with this solicitation, but we expect to be reimbursed by a third party for these out-of-pocket expenses.costs of solicitation. Copies of solicitation materials will be furnished to brokers and/or other nominees holding shares in their names that are beneficially owned by others so that they may forward the solicitation material to such beneficial owners upon request. We will reimburse these partiesbrokers and/or other nominees for reasonable expenses incurred by them in sending proxy materials to our stockholders. In addition to the solicitation of proxies by mail, our directors, officers, and employees may solicit proxies by telephone, facsimile, or personal interview. No additional compensation will be paid to these individuals for any such services. We have hired Broadridge Financial Solutions, Inc. to assist us in the distribution of proxy materials. We have also retainedengaged a third-party solicitor, Georgeson LLC, who may solicit proxies by telephone or by other means of communication on our behalf. The cost for this service is estimated at $20,000, including expenses. In addition, we have agreed to aidindemnify Georgeson LLC against certain claims, liabilities, losses, damages and expenses arising out of or in and advise on certain matters relating to the Special Meeting for a fee of approximately $30,000.connection with these services. How can I find the voting results? We plan to announce preliminary voting results at the meeting and will publish final results in a Current Report on Form 8-K to be filed with the SEC within four business days following the Special Meeting.annual meeting. Stockholder Proposals for 2024 Annual Meeting Stockholder proposals that are intended to be presented at our 2024 annual meeting of stockholders and included in our proxy statement relating to the 2024 annual meeting, pursuant to Rule 14a-8 promulgated under the Exchange Act, must be received by us no later than December 8, 2023, which is 120 calendar days before the anniversary of the date on which this proxy statement was first distributed to our stockholders. If the date of the 2024 annual meeting is moved more than 30 days from the date of the 2023 annual meeting, the deadline for inclusion of proposals in our proxy statement for the 2024 annual meeting instead will be a reasonable time before we begin to print and send our proxy materials. All stockholder proposals must be in compliance with applicable laws and regulations in order to be considered for possible inclusion in the proxy statement and form of proxy for the 2024 annual meeting. To comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Securities Exchange Act of 1934 no later than March 24, 2024. If a stockholder wishes to request business be brought at our 2024 annual meeting of stockholders (other than matters included in our proxy statement in accordance with Rule 14a-8 under the Exchange Act), the stockholder must give advance notice to us prior to the deadline (the “Bylaw Deadline”) for the annual meeting determined in accordance with our Amended and Restated Bylaws (“bylaws”) and comply with certain other requirements specified in our bylaws. Under our bylaws, in order to be deemed properly presented, the notice of a proposal, including nominations for the election of directors, must be delivered to our Corporate Secretary no later than February 21, 2024, which is 45 calendar days prior to the first anniversary of the date on which we mailed the proxy materials for the 2023 annual meeting.

However, if we change the date of the 2024 annual meeting so that it occurs more than 30 days prior to, or more than 30 days after, May 25, 2024, stockholder proposals intended for presentation at the 2024 annual meeting, but not intended to be included in our proxy statement relating to the 2024 annual meeting, must be delivered to or mailed and received by our Corporate Secretary at 2 Mill & Main Place, Suite 395, Maynard, Massachusetts 01754 no later than the close of business on the ninetieth calendar day prior to the 2024 annual meeting or the twentieth calendar day following the day on which public disclosure of the date of the 2024 annual meeting is first made (the “Alternate Date”). We also encourage you to submit any such proposals via email to investors@aquabounty.com. If a stockholder gives notice of such proposal after the Bylaw Deadline (or the Alternate Date, if applicable), the stockholder will not be permitted to present the proposal to the stockholders for a vote at the 2024 annual meeting. Additional requirements applicable to notices of stockholder proposals are set forth in our bylaws.We have not been notified by any stockholder of his or her intent to present a stockholder proposal from the floor at this annual meeting. The enclosed proxy grants the proxy holders discretionary authority to vote on any matter properly brought before the annual meeting or any adjournment or postponement thereof.

MATTERS TO BE CONSIDERED AT THE SPECIALANNUAL MEETING

PROPOSAL 1: RATIFICATIONELECTION OF DIRECTORS

Our Board has determined that it is advisable and in the best interests of the Company and our stockholders to ratify, pursuant to Section 204 of the DGCL, the approval, filing and effectiveness of the certificate of amendment to our Certificate of Incorporation filed with the Secretary of State on May 27, 2022 (the “Share Increase Amendment”) and the increase in the number of shares of our authorized Common Stock effected thereby from 80,000,000 to 150,000,000 shares (the “Ratification”). This Ratification shall be retroactive to the effectiveness of the filing of the Share Increase Amendment with the Secretary of State on May 27, 2022.

Background on the Ratification

As described in the definitive proxy statement relating to our 2022 Annual Meeting, which was filed with the SEC on April 14, 2022 (as supplemented by the additional definitive soliciting material filed with the SEC on May 16, 2022, the “2022 Annual Meeting Proxy Statement”), the Share Increase Amendment was proposed to increase the authorized number of shares of Common Stock in order to, among other reasons, provide the Company with the ability to raise the capital necessary to continue and grow its operations. The Board believed that the ratio of issued shares to authorized shares was potentially restrictive and not in line with similar agriculture-technology companies, and approved the Share Issuance Amendment to lower our issued shares to authorized shares ratio and provide sufficient reserves of authorized but unissued shares to generally support growth and to provide flexibility for future corporate needs, including but not limited to grants under equity compensation plans, stock splits, financings and potential strategic transactions, as well as other general corporate transactions. The additional authorized shares enable us to issue shares in the future in a timely manner and under circumstances we consider favorable without incurring the risk, delay and potential expense incident to obtaining stockholder approval for a particular issuance.

At the 2022 Annual Meeting, the Company’s stockholders voted on the Share Increase Amendment. Consistent with the applicable rules concerning the manner in which brokerage firms, banks, broker-dealers, or other similar organizations (collectively, “brokers and/or other nominees”) may exercise discretionary authority to vote on “routine” matters, certain shares of Common Stock held by brokers and/or other nominees and with respect to which the beneficial owners had not provided their broker and/or other nominee with voting instructions were voted by the brokers and/or other nominees in favor of the approval of the Share Increase Amendment. Such votes, and others cast by our stockholders, were tabulated by our inspector of elections in accordance with the applicable NYSE rules, and, based on the tabulation, our inspector of elections determined that the proposal to approve the Share Increase Amendment was adopted by the requisite vote of stockholders and certified that the proposal had passed. In particular, there were 27,376,357 votes cast by stockholders on the Share Increase Amendment, of which 25,606,826 were voted “FOR,” 1,568,694 were voted “AGAINST,” and 200,837 votes abstained. Brokers and/or other nominees cast an additional 17,718,415 votes on the Share Increase Amendment, of which 14,811,907 were cast “FOR,” 2,646,023 were cast “AGAINST,” and 260,485 abstained. The affirmative vote for the Share Increase Amendment, at 57% of the shares of Common Stock outstanding as of the record date for the 2022 Annual Meeting, was sufficiently in excess of the required approval of a majority of our outstanding shares of Common Stock to effect the Share Increase Amendment. Following this approval, we filed the Share Increase Amendment with the Secretary of State on May 27, 2022 and it became effective on the same date.

On June 24, 2022, the Company received a letter on behalf of a stockholder alleging that disclosures in the 2022 Annual Meeting Proxy Statement regarding the authority of brokers and/or other nominees to vote on the Share Increase Amendment in the absence of instructions were inconsistent with how votes were tabulated and counted. In particular, the stockholder observed that the 2022 Annual Meeting Proxy Statement identified the Share Increase Amendment as “non-routine” and stated that brokers and/or other nominees could not vote on this matter unless beneficial owners provided voting instructions. Although this stockholder did not claim to have been under a misimpression prior to the 2022 Annual Meeting and no other stockholder reported any confusion or made any inquiry with the Company regarding the language on this matter in the 2022 Annual Meeting Proxy Statement at any time prior to June 24, 2022, the stockholder stated that an unidentified and unspecified number of other stockholders might have been opposed to the Share Increase Amendment but, because they believed that providing no instruction would prevent their brokers and/or other nominees from casting an affirmative vote in favor of the proposal, declined to instruct their brokers and/or other nominees on the Share Increase Amendment rather than voting against the proposal. For this reason, the stockholder suggested that the votes of brokers and/or other nominees should not have been counted with respect to the Share Increase Amendment, and that the Board should deem the Share Increase Amendment ineffective and make appropriate disclosure of such determination, or seek valid stockholder approval of the Share Increase Amendment.

The Board believes it was and is appropriate to include the affirmative votes cast by brokers and/or other nominees pursuant to their discretionary authority in the tabulation of votes in favor of the Share Increase Amendment and, thus, that the Share Increase Amendment was properly approved and is effective. However, to avoid potential future litigation risk, and to eliminate any uncertainty as to the Share Increase Amendment and the validity of shares of Common Stock that in the future may be issued by virtue of the Share Increase Amendment, the Board has determined that it is advisable and in the best interests of the Company and its stockholders to ratify the approval, filing and effectiveness of the Share Increase Amendment pursuant to Section 204 of the DGCL. In furtherance of this Ratification, the Board unanimously adopted the resolutions attached hereto as Appendix A on August 3, 2022, resolving, among other things, to approve the ratification of the Share Increase Amendment, subject to stockholder ratification, and recommend that stockholders approve the ratification of the Share Increase Amendment. If the Ratification is approved by our stockholders and becomes effective, the ratification of the Share Increase Amendment will be retroactive to May 27, 2022, which was the date of the filing and effectiveness of the Share Increase Amendment with the Secretary of State.

The Ratification will provide the Company with certainty regarding the ability to raise the capital necessary to continue and grow its operations by providing sufficient reserves of authorized but unissued shares to generally support growth and to provide flexibility for future corporate needs, including but not limited to grants under equity compensation plans, stock splits, financings, potential strategic transactions, as well as other general corporate transactions. No specific transaction was contemplated in connection with the Share Increase Amendment, and as of this date, none of the shares authorized by the Share Increase Amendment have been issued. Once the Ratification is approved, the additional authorized shares pursuant to the Share Increase Amendment will enable us to issue shares in the future in a timely manner and under circumstances we consider favorable without incurring the risk, delay and potential expense incident to obtaining stockholder approval for a particular issuance.

Our Board recommends that you vote “FOR” the Ratification.

Matters Related to Section 204 of the DGCL

Sections 204 and 205 of the DGCL are attached hereto as Appendix B.

Section 204 of the DGCL allows a Delaware corporation, by following specified procedures, to ratify a corporate act retroactive to the date the corporate act was originally taken. Our Board believes that the Share Increase Amendment was properly approved and is effective. However, to avoid potential future litigation risk and to eliminate any uncertainty as to the Share Increase Amendment and the validity of shares of Common Stock that in the future may be issued by virtue of the Share Increase Amendment, on August 3, 2022, our Board determined that it would be advisable and in the best interests of the Company and its stockholders to ratify the approval, filing and effectiveness of the Share Increase Amendment pursuant to Section 204 of the DGCL and unanimously adopted the resolutions attached hereto as Appendix A (such resolutions are incorporated herein by reference) approving the Ratification. Our Board also recommended that our stockholders approve the Ratification for purposes of Section 204, and directed that the Ratification be submitted to our stockholders entitled to vote thereon for approval.

Subject to the receipt of the required vote of our stockholders to approve the Ratification, we expect to file the Certificate of Validation with respect to the Share Increase Amendment with the Secretary of State promptly after the adjournment of the Special Meeting. The filing date of the Certificate of Validation with the Secretary of State will be the validation effective time of the Ratification within the meaning of Section 204 of the DGCL.

If the Ratification becomes effective, under the DGCL, any claim that (i) the Share Increase Amendment ratified pursuant to the Ratification is void or voidable due to a failure of authorization or (ii) the Delaware Court of Chancery should declare, in its discretion, that the Share Increase Amendment not be effective or be effective only on certain conditions must be brought within 120 days from the validation effective time in respect of the Ratification, which will occur upon the effectiveness of the filing of the Certificate of Validation with the Secretary of State. If the Ratification is approved at the Special Meeting, we expect to file the Certificate of Validation promptly after the adjournment of the Special Meeting.

Consequences if the Ratification is Not Approved by Our Stockholders

If the Ratification is not approved by the requisite vote of our stockholders, we will not be able to file the Certificate of Validation with the Secretary of State and the Share Increase Amendment will not be ratified in accordance with Section 204 of the DGCL. The failure to approve the Ratification may leave us exposed to potential claims that (i) the Share Increase Amendment did not receive requisite stockholder approval at the 2022 Annual Meeting, and therefore was not validly filed with the Secretary of State and is not currently effective, (ii) as a result, the Company does not have sufficient authorized but unissued shares of Common Stock to permit future issuances of Common Stock, including pursuant to outstanding warrants, stock options and other convertible securities, and (iii) actions taken by the Company in reliance on the effectiveness of the Share Increase Amendment were improperly effected, although the Company believes that any such claims would be without merit. In addition, the failure to approve the Ratification may preclude us from pursuing, or impair our ability to pursue, a wide range of potential corporate opportunities that might require working capital or additional financing, or otherwise be in the best interests of our stockholders, which could have a material adverse effect on our business and prospects.

Interests of Directors and Executive Officers

Our directors and executive officers have no material interests, directly or indirectly, in the matters set forth in this proposal except to the extent of their ownership of shares of our Common Stock they own and equity awards granted to them under our equity incentive plans.

Vote Required

The affirmative vote of the holders of a majority of the outstanding shares of Common Stock entitled to vote at the Special Meeting is required to approve the Ratification.

Recommendation of the Board

Our Board recommends that the stockholders vote “FOR” FOR the Ratification. PROPOSAL 2:

ADJOURNMENT PROPOSAL

StockholdersOur Charter provides for the appointment to our Board of up to nine directors, who are being askedelected for a one-year term to considerhold office until the next annual meeting of our stockholders or until removed from office in accordance with our bylaws. The nominees named below have agreed to serve if elected, and vote upon an adjournment by stockholders ofwe have no reason to believe that they will be unavailable to serve. If, however, the Special Meeting from timenominees named below are unable to time, if necessaryserve or advisable (as determined by the Company),decline to solicit additional proxies in the event there are not sufficient votesserve at the time of the Specialannual meeting, the proxies will be voted for any nominee who may be designated by our Board. Richard J. Clothier is not standing for re-election at the annual meeting, and as a result, his term as director will end at the annual meeting. We expect that the sitting directors will elect a new Board Chair subsequent to the annual meeting, pursuant to our bylaws. Unless a stockholder specifies otherwise, a returned, signed proxy will be voted FOR the election of each of the nominees listed below.

The following table sets forth information with respect to the persons nominated for re-election at the annual meeting: | | | | | | | | | Director | | Committees | Name | Age | Since | Position(s) | Audit | Comp | Nom-Gov | Ricardo J. Alvarez | 67 | 2021 | Director | | Mem | Chair | Erin Sharp | 65 | 2022 | Director | Mem | | | Gail Sharps Myers | 53 | 2021 | Director | Mem | Chair | | Christine St.Clare | 72 | 2014 | Director | Chair | | Mem | Rick Sterling | 59 | 2013 | Director | Mem | Mem | | Michael Stern | 62 | 2022 | Director | | | Mem | Sylvia A. Wulf | 65 | 2019 | Director, CEO and President | | | |

Ricardo J. Alvarez. Dr. Alvarez joined the Board of AquaBounty in March 2021. He is currently the CEO of J&K Ingredients, a leading manufacturer of bakery ingredients globally. Prior to J&K Ingredients, he served as President and CEO of various food manufacturing companies including Passport Foods (SVC), LLC, Richelieu Foods, Ruiz Foods, Anita's Foods, Overhill Farms and Raymundo's Food Products. In his 25 years as a leader in the packaged food industry, Dr. Alvarez has implemented growth strategies including new go-to-market initiatives, geographic expansion and innovations of both product and packaging. Dr. Alvarez also has extensive board experience, having served on the boards of Bush Brothers Inc., Clement Pappas Inc., Ruiz Foods and Clear Springs Foods. He currently serves on the board of Phelps Pet Products Inc. Dr. Alvarez brings operational and food industry experience to our Board. Erin Sharp. Ms. Sharp joined the Board of AquaBounty in May 2022 and recently retired as Group Vice President of Manufacturing and Enterprise Sourcing for The Kroger Co. (NYSE: KR), where she was a Senior Officer having responsibility for companywide manufacturing, food safety and sourcing. Prior to her 10 years with The Kroger Co, Ms. Sharp had increasing leadership roles in operations and finance with several large consumer product companies; including Sara Lee, Nestle Dreyer’s and Frito Lay. She served as a board member for the national nonprofit organization Feeding America as well as several industry boards including American Bakers Association, where she was the first female Chair, MilkPEP and the International Dairy Association. Ms. Sharp earned a bachelor’s degree from the University of Western Ontario and a Master’s in Business Administration from the University of Texas. Ms. Sharp brings operational and food industry experience to our Board. Gail Sharps Myers. Ms. Sharps Myers joined the Board of AquaBounty in May 2021. She has been Executive Vice President, Chief Legal Officer and Chief People Officer at Denny’s Corporation (NASDAQ:DENN) since February 2021. She previously served as Senior Vice President, General Counsel and Secretary of Denny’s since September 2020 and as Senior Vice President and General Counsel from June 2020 to September 2020. Prior to joining Denny’s, she served as Executive Vice President, General Counsel, Chief Compliance Officer and Secretary of American Tire Distributors, Inc. from May 2018 to May 2020, as Senior Vice President, General Counsel and Secretary at Snyder’s-Lance, Inc. (NASDAQ:LNCE) from January 2015 to March 2018 and as Senior Vice President, Deputy General Counsel, Chief Compliance Counsel and Assistant Secretary from 2014 to 2015 at US Foods, Inc. She received her Doctor of Jurisprudence from The Washington College of Law at The American University, her Master’s in Business Administration from Arizona State University's W. P. Carey School of Business and her Bachelor of Arts in Political Science at Howard University. Ms. Sharps Myers’ experience and background make her well suited to serve on our Board.

Christine St.Clare. Ms. St.Clare joined the Board of AquaBounty in May 2014. She is a former Audit Partner at KPMG LLP (“KPMG”) serving publicly traded companies until 2005, after which she transferred to the Advisory Practice, working in the Internal Audit, Risk and Compliance Practice until her retirement in 2010. She also served a four-year term on KPMG’s Board of Directors, where she chaired KPMG’s Audit and Finance Committee for three of the four years. She has served on the Board of Directors for Tilray, Inc. (“Tilray”) (NASDAQ:TLRY), from their 2018 IPO through April 2021. At Tilray, she chaired the Audit Committee and was a member of the Nominating & Governance Committee and the Compensation Committee. She formerly served on the boards of both Fibrocell Science, Inc. (“Fibrocell”), a company that specialized in the development of personalized biologics and Polymer Group, Inc. (“Polymer”), a global manufacturer of engineered materials. Fibrocell was a NASDAQ listed company and Polymer was a Blackstone portfolio company with publicly traded debt. For both Fibrocell and Polymer, Ms. St.Clare served as the Audit Committee Chair until their respective sales to strategic buyers. Ms. St.Clare holds a Bachelor of Science in accounting from California State University at Long Beach and has been a licensed Certified Public Accountant in California, Texas and Georgia. Ms. St.Clare’s background in accounting and support of publicly held companies, as well as her experience with biotechnology, makes her well suited for service on our Board. Rick Sterling. Mr. Sterling has served on the Board of AquaBounty since September 2013. He served as the Chief Financial Officer at Precigen Inc. (NASDAQ:PGEN) (“Precigen”) from 2007 through March 2021, including leading them through their initial public offering in 2013. During his term at Precigen, Mr. Sterling was responsible for multiple private and public equity and debt capital raises, financial diligence for and integration of over a dozen acquisitions, SEC reporting and compliance, divestitures of businesses, budgeting, and negotiations of facility leases as well as oversight of human resource and information technology functions. Prior to joining Precigen, he was with KPMG where he worked in the audit practice for over 17 years, with a client base primarily in the healthcare, technology and manufacturing industries. He has a Bachelor of Science in Accounting from Virginia Tech and is a licensed Certified Public Accountant. Mr. Sterling’s background in audit and finance, as well as his experience with technology companies, make him well suited for service on our Board. Michael Stern. Dr. Stern joined the Board of AquaBounty in May 2022 and is the former CEO of The Climate Corporation and Digital Farming for Bayer Crop Science (“Bayer”) and a member of the Crop Sciences Executive Team. Before joining Bayer, Dr. Stern had a 30-year career at Monsanto Company (NYSE:MON) (“Monsanto”), where he was a member of Monsanto’s Executive Team and led their Row Crop Business in the Americas. In addition, Dr. Stern served in a variety of leadership roles at Monsanto, including Vice President of U.S. Seeds and Traits, President of American Seeds, CEO of Renessen LLC, a biotechnology joint venture with Cargill, and Director of Technology for Agricultural Productivity. Dr. Stern is a member of the Board of Directors of Lavoro Limited (“LVRO”). Dr. Stern also serves as Chairman of the Board of Trustees for the Missouri Botanical Garden and served on the board of the Monsanto Fund and the board of Clara Foods, a San Francisco based company focused on developing novel animal proteins from cell culture. Dr. Stern received a Ph.D. in Chemistry from Princeton University, a MS in Chemistry from the University of Michigan and a BS degree from Denison University. Dr. Stern’s brings broad experience in the food industry and biotechnology to our Board.

Sylvia Wulf. Ms. Wulf was appointed Executive Director, President, and Chief Executive Officer of AquaBounty in January 2019. Prior to joining AquaBounty, Ms. Wulf served as a Senior Vice President of US Foods, Inc. (NYSE:USFD), where she had been President of the Manufacturing Division since June 2011. Prior to US Foods, Ms. Wulf held senior positions in Tyson Foods, Inc. (NYSE:TSN), Sara Lee Corporation, and Bunge Corp (NYSE:BG). She is also currently on the Board of Directors and the Executive Committee of both the National Fisheries Institute and the Biotechnology Industry Organization. Ms. Wulf received a Bachelor of Science in Finance from Western Illinois University and a Master’s in Business Administration from DePaul University. Ms. Wulf provides extensive experience in the food industry in North America, including its fish sector to our Board. Our Executive Officers The following table identifies our executive officers who are not members of our Board and sets forth their current positions with us. | | | | Name | Age | Officer Since | Position(s) | David A. Frank | 62 | 2007 | Chief Financial Officer and Treasurer | Angela Olsen | 54 | 2019 | General Counsel and Corporate Secretary | Alejandro Rojas | 61 | 2014 | Chief Operating Officer, AquaBounty Farms |

David A. Frank. Mr. Frank was appointed Chief Financial Officer and Treasurer of AquaBounty in October 2007. Angela M. Olsen. Ms. Olsen was appointed General Counsel and Corporate Secretary in November 2019. Prior to joining AquaBounty, she served as Senior Advisor and Associate General Counsel atE.I. du Pont de Nemours and Company (NYSE:DD) between 2017 and 2019. Alejandro Rojas. Mr. Rojas joined AquaBounty as the Chief Operating Officer of AquaBounty Farms (our wholly owned subsidiary) in February 2014. Our executive officers are elected by our Board and hold office until removed by the Board, and until their successors have been duly elected and qualified or until their earlier resignation, retirement, removal, or death. The principal occupation and employment during the past five years of each of our executive officers was carried on, in each case except as specifically identified above, with a corporation or organization that is not a parent, subsidiary or other affiliate of us. There is no arrangement or understanding between any of our executive officers and any other person or persons pursuant to which they were or are to be selected as an executive officer. There are no material legal proceedings to which any of our executive officers or any associate of any such executive officer is a party adverse to us or any of our subsidiaries or in which any such person has a material interest adverse to us or any of our subsidiaries. Corporate Governance Principles We are committed to having sound corporate governance principles. Having such principles is essential to maintaining our integrity in the marketplace. Our Code of Business Conduct and Ethics and the charters for each of the Audit, Compensationand Human Capital, and Nominating and Corporate Governance (“NCG”) Committees are available on the investor relations section of our corporate website (www.aquabounty.com). A copy of our Code of Business Conduct and Ethics and the committee charters may also be obtained upon request to Corporate Secretary, AquaBounty Technologies, Inc., 2 Mill & Main Place, Suite 395, Maynard, Massachusetts 01754. Environmental, Social and Governance Historically, we have viewed the focus on Environmental, Social and Governance (“ESG”) concerns as foundational to a well-run business and fundamental to our Purpose and Values, as well as a critical aspect of how we operate our business, deliver results and drive continuous improvement. We embraced ESG early in the development of our business practices, as we see it as a critical component to building our culture and as a strategic imperative for identifying increased efficiencies and effectiveness as we grow. The ESG reporting requirements and norms will continue to evolve and we will continue to monitor those changes. We believe taking ESG considerations into account in our decision-making process ensures a disciplined approach to risk management. Our ESG Committee, comprised of our executive management team with oversight by our Board, has worked cross functionally to develop our strategy, structure, processes and the roadmap for the standards that are relevant to our business. In 2021, we took an important step in our corporate governance evolution by committing to deeper understanding of material non-financial matters of our business across ESG aspects. We deployed a rigorous process where we identified and interviewed external advisors/consulting groups that would provide expertise to assist in developing and implementing our ESG initiatives and selected a qualified strategic counsel and partner. We also identified and implemented a digital system platform to track data inputs used for reporting calculations and to ensure we are collecting data and other ESG inputs on a consistent and ongoing basis. Following a thorough review of the various ESG reporting standards, we selected the SASB Framework as our primary standard, as the accounting metrics for the Food Sector contain topics that are more specific and pertinent to our business model and operations during the current reporting period. Additionally, our program and reporting incorporate alignment with several applicable GRI metrics and the United Nations Sustainable Development Goals (“UNSDGs”). In our initial ESG materiality assessment we chose to focus on the aspects of (i) energy and water management; (ii) consumer welfare and employee health and safety; and (iii) diversity and inclusion, humane and considerate animal welfare, and sound governance and oversight structure. For more information on our ESG efforts, please read our Annual Report on Form 10-K for the year ended December 31, 2022. Code of Ethics Our Board has adopted the Code of Business Conduct and Ethics that applies to all of our employees, officers and directors, including, but not limited to, our Chief Executive Officer and Chief Financial Officer and other executive and senior financial officers. The Code of Business Conduct and Ethics constitutes our “code of ethics” within the meaning of Section 406 of the Sarbanes-Oxley Act and is our “code of conduct” within the meaning of the listing standards of The Nasdaq Stock Market LLC (“Nasdaq”). Our Code of Business Conduct and Ethics is posted to our website, and we intend to disclose any amendment or waiver of a provision thereof that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing

similar functions, by posting such information on our website (available at www.aquabounty.com) and/or in our public filings with the SEC. During fiscal year ended December 31, 2022, no waivers were granted from any provision of the Code of Business Conduct and Ethics. Policy on Trading, Pledging and Hedging of Our Common Stock Certain transactions in our securities (such as purchases and sales of publicly traded put and call options, and short sales) create a heightened compliance risk or could create the appearance of misalignment between management and stockholders. In addition, securities held in a margin account or pledged as collateral may be sold without consent if the owner fails to meet a margin call or defaults on the loan, thus creating the risk that a sale may occur at a time when an officer or director is aware of material, nonpublic information or otherwise is not permitted to trade in Company securities. Our insider trading policy expressly prohibits short sales and derivative transactions of our stock by our employees, officers and directors, including hedging, short sales of our securities and the purchase or sale of puts, calls, or other derivative securities of the Company or any derivative securities that provide the economic equivalent of ownership. To our knowledge, each of our directors and executive officers complied with this policy during 2022. Stockholder Communications with Directors Stockholders may communicate with our directors by sending communications to the attention of the Chairman of the Board, the Chairperson of a committee of the Board, or an individual director via U.S. Mail or Expedited Delivery Services to our address at AquaBounty Technologies, Inc., 2 Mill & Main Place, Suite 395, Maynard, Massachusetts 01754. The Company will forward by U.S. Mail any such communication to the mailing address most recently provided by the Board member identified in the “Attention” line of the communication. All communications must be accompanied by the following information: | · | | A statement of the type and amount of the securities of the Company that the submitting individual holds, if any; |

| · | | Any special interest, other than in the capacity of security holder, of the submitting individual in the subject matter of the communication; and |

| · | | The address, telephone number, and email address of the submitting individual. |